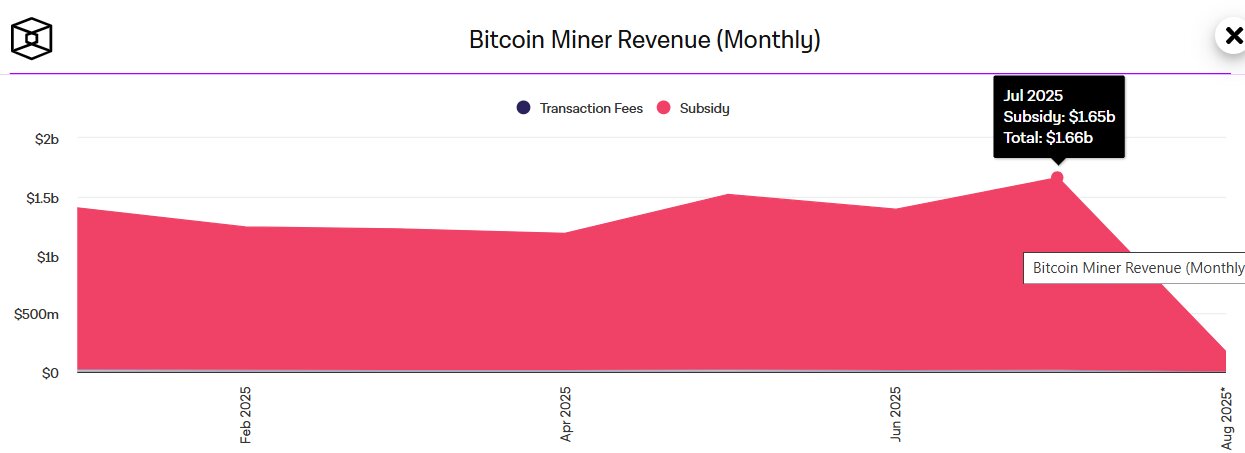

Bitcoin mining has surged to new heights. In July 2025, Bitcoin miners revenue reached an astonishing $1.66 billion. This figure symbolises an important milestone.

It reflects a 19% increase from June 2025’s $1.39 billion. Moreover, it showcases a remarkable 75% year-on-year (YoY) growth from July 2024’s $951 million.

July 2025 is now the most profitable month for miners, with $1.52 billion more than in May 2025. This article explores the factors driving this revenue boom, identifies top-performing companies, and evaluates Bitcoin’s investment potential.

Understanding the Bitcoin Miners Revenue Surge

The $1.66 billion revenue in July 2025 shows the resilience of Bitcoin mining. Several factors fuel this growth.

First and foremost, Bitcoin’s price surged, boosting block rewards and transaction fees. Additionally, advancements in mining hardware, like Bitmain’s Antminer S21 series, enhanced efficiency.

Meanwhile, miners leveraged renewable energy sources, cutting costs. As a result, profitability soared. The 19% month-on-month (MoM) increase from June highlights sustained network activity.

Furthermore, the 75% YoY jump from July 2024 reflects Bitcoin’s growing adoption.

These metrics signal a robust industry, but which companies reaped the most rewards?

What Companies Benefitted Most from Miners Revenue?

Several mining giants capitalised on July’s revenue spike. Marathon Digital Holdings emerged as the top performer. The company expanded its Texas and North Dakota operations, using wind and solar power.

As a result, Marathon mined significant Bitcoin volumes, boosting its revenue.

Similarly, Riot Platforms thrived, generating $142.9 million in Q1 2025 alone. Its focus on hyperscaler partnerships and a 19,225 BTC treasury strengthened its position.

Hut 8 Mining expanded its operations into AI data centres, raising $220 million to bolster its infrastructure with cutting-edge equipment.

This strategic pivot ensured stable income despite market volatility. Additionally, Bitfarms and Core Scientific scaled operations, leveraging next-gen ASICs for higher hash rates.

These companies’ adaptability and investments in sustainable energy drove their success. However, what does this mean for Bitcoin’s price trajectory?

Will Bitcoin Breach $150,000?

Bitcoin’s price is a hot topic. In November 2024, it topped $90,000, fuelled by institutional adoption. For instance, U.S. President Donald Trump’s 2025 executive order made Bitcoin a strategic reserve asset. This move legitimised the cryptocurrency, attracting institutional investors.

This is why analysts speculate Bitcoin could reach $150,000 by 2026. Several factors support this prediction. Initially, the April 2024 halving slashed block rewards to 3.125 BTC, constricting supply. Meanwhile, growing enthusiasm for decentralised finance (DeFi) and blockchain innovation is driving positive market sentiment.

However, challenges like regulatory scrutiny and energy concerns persist. Despite these hurdles, Bitcoin’s momentum suggests a potential breach of $150,000. Yet, is it a wise investment?

Is Bitcoin a Good Investment?

Bitcoin remains a polarising asset. Its volatility attracts risk-tolerant investors. In 2025, cryptocurrency miners generated $11.2 billion in revenue, reflecting a 7.1% year-over-year growth.

This growth reflects Bitcoin’s enduring appeal. Moreover, its capped supply of 21 million coins ensures scarcity, driving value. Institutional backing, like Marathon’s 50,000 BTC treasury, adds credibility.

Despite these positive metrics, Bitcoin still operates within a highly volatile world. Energy-intensive mining raises environmental concerns, potentially inviting stricter regulations.

Additionally, market fluctuations can erode gains. For instance, the drops in hashprice after the halving event have negatively impacted mid-tier miners. Nevertheless, Bitcoin’s integration into mainstream finance, like payment systems in malls, signals long-term potential.

Thus, it remains a compelling, albeit risky, investment. Is this the perfect moment to invest in the largest digital asset in terms of market capitalisation?

Is Now Still a Favourable Time to Buy Bitcoin?

Timing is critical in crypto investing. July 2025’s record-breaking miners revenue suggests strong market momentum. Bitcoin’s consistent price hold above $100,000 reflects strong market optimism.

Furthermore, clearer regulations in the United States (US) and the European Union (EU) foster investor confidence. For example, the Securities and Exchange Commission (SEC)’s March 2025 ruling clarified that Proof-of-Work (PoW) mining isn’t a security. This lowers regulatory uncertainties for both miners and investors.

Additionally, 54% of mining firms now use renewable energy, addressing environmental concerns.

However, challenges remain. Rising electricity costs and mining difficulty, at 113.76 trillion in 2025, pressure profitability. Retail investors, contributing 10% of the global hash rate, face higher entry barriers.

Still, cloud mining platforms like Genesis Mining offer accessible entry points. Therefore, while the risks persist, the current market favours strategic investments.

The Broader Implications of Rising Bitcoin Miners Revenue

The $1.66 billion revenue in July 2025 reflects broader trends. First, Bitcoin’s dominance in mining persists as a result of Ethereum’s permanent shift to proof-of-stake.

Additionally, regions such as Texas, which accounts for 28.5% of North America’s hash rate, are leading because of their access to renewable energy.

Similarly, El Salvador’s geothermal mining and Oman’s gas-powered operations highlight global diversification.

Furthermore, the industry’s pivot to AI and high-performance computing opens new revenue streams.

For instance, Hive’s $115 million in revenue for fiscal year 2025 on the back of AI and High Performance Hosting (HPC) shows adaptability. These trends suggest miners are future-proofing their operations. Consequently, the industry’s growth aligns with Bitcoin’s rising mainstream acceptance.

Challenges and Opportunities Ahead

Despite the revenue surge, challenges loom. The halving event in April 2024 reduced block rewards, which has increased competition among miners. Additionally, increasing mining difficulty requires greater computational resources.

Meanwhile, environmental regulations push for sustainability. For example, Norway’s 96% hydropower-based mining sets a green standard. However, opportunities abound. Next-gen Application-Specific Integrated Circuits (ASICs), with 35% better hash rates, boost efficiency.

Additionally, institutional investments, like Loka’s mining pool for investors, signal confidence. Additionally, retail engagement will continue to soar in 2025, fuelled by the rise of cloud mining. These elements foster a vibrant ecosystem where innovation propels expansion.

Conclusion: A Thriving Yet Evolving Industry

In July 2025, Bitcoin miners achieved a record-breaking revenue of $1.66 billion, setting a new milestone.

The 19% month-on-month and 75% YoY growth highlight the industry’s strength.

Companies like Marathon, Riot, and Hut 8 lead by embracing innovation and sustainability.

Meanwhile, Bitcoin’s potential to hit $150,000 fuels optimism. As an investment, it offers high rewards but carries risks. For now, favourable regulations and market momentum make it an attractive investment.

However, investors must weigh volatility and costs. Ultimately, the mining industry’s adaptability ensures its relevance in a digital future.

Researched and Written by Raphael Minter